The section taxes and fees allows you to create parameters for the formation of added value in the reservation to display additional charges for accommodation, if it is established by regional authorities.

The setting is flexible, which makes it possible to form almost any type of taxes and fees. The cost will be automatically added to the reservation when you manually create it. In reservations that come from booking channels, taxes and fees will not be displayed, but when manually re-saving, the cost will be added to absolutely all reservations. It is also possible to remove any fee on each reservation individually.

To set up Taxes and Fees, you must first configure the age groups of children

Next, we move on to creating taxes and fees, consider in detail the customization options:

- To create click on the button

- A new window “Taxes and Fees” opens

- It is necessary to indicate the name of the tax or fee in free form (Will be displayed in the reservation)

- Select which category the created parameter “Taxes” or “Fees” belongs to (If you select Fees, the VAT window appears, where you can specify the amount of VAT)

- The next step is to select the parameters of charges from 3 pricing groups:

![]()

1.

![]()

Per room – means that the amount will be formed based on the cost of the room in the room type in which the reservation will be created.

When choosing Per person, 2 additional groups of charges appear:

Per reservation info means that the cost will be formed depending on the number of people selected when creating a reservation.

Per check-in info means that the cost will be formed depending on the number of guest profiles added in the reservation viewing mode and resave the reservation to recalculate the tax or fee.

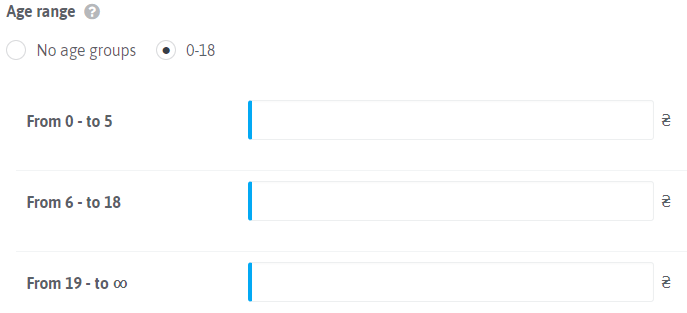

The options for adjusting by age range appear below:

When you select a range, fields are displayed where you can put down a cost for each age group, it will also be charged through the choice of the number of guests when creating a reservation or when adding a guest card indicating the date of birth.

2.

![]()

Per day means that the cost will be charged for each day of stay.

Per stay means that the cost will be added to the reservation once.

3.

![]()

The fixed cost will be charged in monetary terms, according to the set amount in this setting.

% the cost will be charged as a percentage, according to the set amount in this setting.

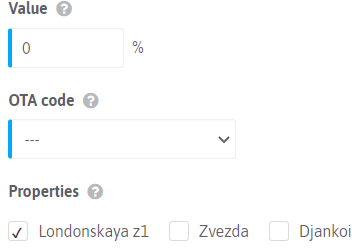

- In the Value field, specify in numbers the value of the levy taxes and fees.

- In the OTA code field, select which type the parameter belongs to; in the future, it will be applied to booking channels such as Tripadvisor, Booking.com.

- Tick off the property in the system to which the tax or fee will be applied.

Check all the information entered and click on the button ![]()

Русский

Русский Polski

Polski Español

Español ქართული

ქართული Українська

Українська